The analysis of the trend for main raw material of PowderCoatings

2020-04-10

The analysis of the trend for main raw material of PowderCoatings

2020-02-21

-

Polyester Resin

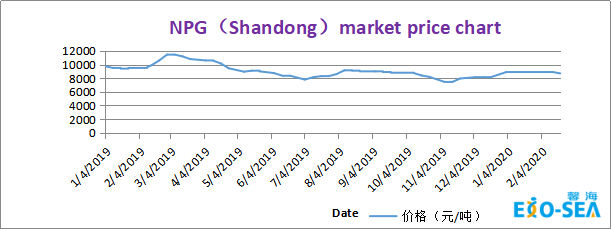

PTA and NPG ------the two main raw materials of Polyester Resin, the market price of PTA was generally decreasing,and NPG ( Shandong) was overall stable but showing a downward trend. The charts are as follows.

Raw material: Affected by the rebound in international crude oil prices, PTA prices rebounded slightly. In the short term, the continuous increase in crude oil prices has increased costs, and the downstream has gradually entered the resumption phase, but the logistics recovery situation is not favorable. Under the pressure of supply and demand, PTA is expected to focus on maintaining stability in the short term. The overall operating rate of downstream enterprises is low, and sufficient stock has been prepared. Affected by the pandemic, the transportation drivers and vehicles in various logistics areas are difficult to find and the cost increases. The transportation procedures are complicated, which brings a significant decline to the NPG market transactions. It is expected that NPG will maintain stability in the short term.

Supply and demand: Delayed re-work time, weakened downstream customer demand, current polyester start-up load rate is 61.22%;

ECOSEA prediction: The price of ‘Polyester resin’ is expected to stay stable in the end of February and the beginning of March,2020.

2. Epoxy Resin

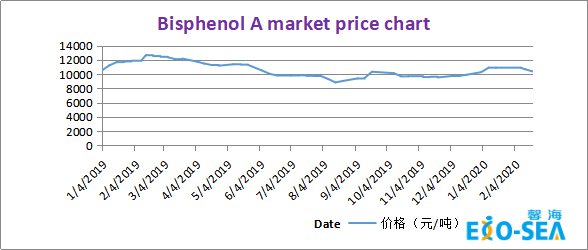

‘Cyclochlorine’ and ‘Bisphenol A’ ------ the two main raw materials of Epoxy resin and the market price charts are as follows.

Raw material: The domestic epichlorohydrin market continued to decline this week, and the trading situation was relatively weak. During the week, the overall start-up of epichlorohydrin production enterprises has not changed much, the market has more inventory, and most downstream resin factories have resumed operation. However, due to the impact of logistics transportation and terminal demand that has not yet been restored, the overall start-up load of the resin factory is relatively low, and new orders in the market are mostly replenishment mainly based on small orders. As of the close of this Thursday, mainstream reference negotiations in the East China market were sent to 10,000 yuan / ton for acceptance; Huangshan market mainstream reference negotiations were 9800-10000 yuan / ton for acceptance; Shandong mainstream reference negotiations were closed at 9600-9800 yuan / ton, expected in the short term, epichlorohydrin will stabilize or drop slightly.

This week's domestic bisphenol A market demand is weak. Although downstream epoxy resin factories have resumed work in succession, most of the raw materials are mainly consumption inventory, and the overall industry operating rate is low. As of the close of Thursday afternoon, the East China bisphenol A market consulted and negotiated 10,400 yuan / ton. In the short term, the price of bisphenol A is expected to stabilize or fall slightly.

Supply and demand: Affected by the pandemic, the time for resumption of work was delayed, downstream customers' demand was flat, and the operating rate of solid manufacturers was about 30%.

ECOSEA prediction: The price of ‘Epoxy resin’ is expected to be stable or drop slightly in the end of February and the beginning of March,2020.

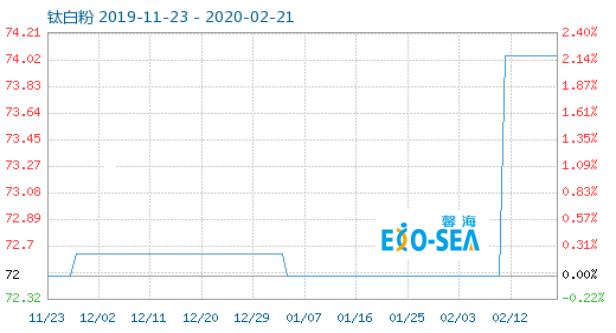

3. Titanium dioxide

The commodities index of Titanium concentrate in the past three months (base on 1st,Sep,2019) is as follows:

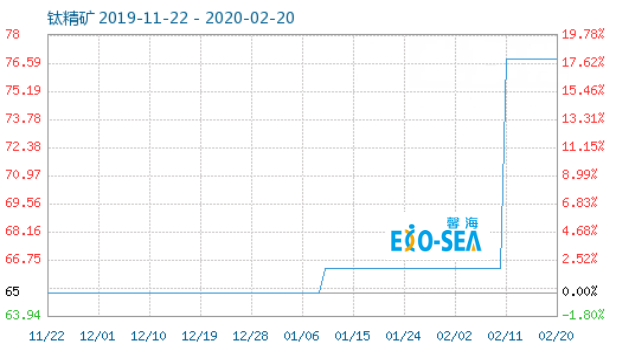

The graph of the Titanium concentrate index in the past three months is as follows:

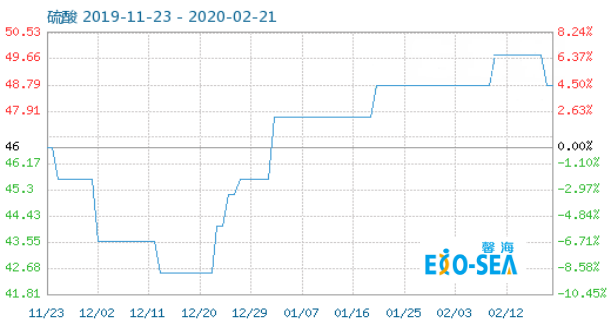

The trend of commodity index of sulfuric acid in the past three months is as follows:

Raw material: This week, Panxi titanium ore production enterprises have resumed construction, and the market supply is relatively tight, with prices mainly rising. Since last week, enterprises have resumed construction. However, the current supply of raw ore is still tight, the market has not started with small and medium-sized enterprises, and the transportation of enterprises by transportation is limited. The market price of imported titanium ore is gradually rising. This week, the regional differences in the domestic sulfuric acid market are obvious. Among them, the supply of smelting acid in Shandong is sufficient but the shipment is not smooth. The main acid companies in the west have lowered their quotations by 10 yuan / ton; the central sulfuric acid enterprises and downstream customers are concentrated in the surrounding areas. In the case of difficulty in the inflow of external acid products, the acid price rose by 20 yuan / ton. Inner Mongolia's acid companies have great pressure on shipment and transportation, and inventory pressures have increased. Some acid companies have flexibly lowered their prices by 10 yuan / ton. The production of acid enterprises in Sichuan has been seriously reduced. With the continuous reduction of supply, some ore acid enterprises have flexibly increased by 20 yuan / ton. The inventory in Gansu is high and the market consumption is slow, and negotiation price in acid market is close to 0 yuan / ton. The acid market in East China shows a good trend, downstream work resumes at a low level, and transactions are flat. As of now, the domestic average price of 98% sulfuric acid mainstream is around 123.18 yuan / ton, inventory consumption is slow, and the price of the acid market has stabilized in the short term. This week, the domestic sulfur market has been steadily increasing, transportation has gradually recovered, and refineries in various regions of the country have basically reduced load production. Some local refineries have been shut down for maintenance. Prices in most regions have been raised by 30-50 yuan / ton, and the average price of domestic sulfur has reached 450.25 yuan. Judging from the current supply and demand performance, refineries in various regions of the country mainly operate temporarily and are expected to maintain stability in the short term.

Supply and demand: Some of the titanium dioxide enterprises are temporarily suspended, and affected by transportation, the market has less inventory on the spot, and the overall downstream procurement demand is flat.

ECOSEA prediction: The price of ‘Titanium dioxide’ is expected to be stable or increase slightly in the end of February and the beginning of March,2020.

4.TGIC Curing Agent

Raw material: The price of epichlorohydrin has been falling slightly since the end of January. During this week, most of the epichlorohydrin plants started construction at low load, and there are factory plants restarted in Hebei area. Some manufacturers have more stocks on the spot, and there is ample supply in the market. And most of the epichlorohydrin plant installations have a relatively stable operating load, and only a few small enterprises are still in the equipment shutdown state. Shandong Haili's restart of the chlorine plant is still in a pending state, the downstream factories are in poor recovery conditions, and procurement demand is flat. At the same time, due to the logistics, the delivery is not smooth, and some of the chlorine manufacturers have a certain inventory pressure. Affected by the pandemic, the factory resumption time was postponed, enterprise employees could not return to their jobs on time, and the production capacity of some factories was restricted. Some TGIC factories are expected to be officially started next week, coupled with the obstruction of logistics and the increase in costs, downstream procurement demand is slowly picking up, and the market's spot inventory is small. TGIC prices will stabilize or rise slightly in the short term.

Supply and demand: Due to the impact of the epidemic situation, the time for resumption of business was delayed, the logistics and transportation were not smooth, the demand of downstream customers slowly picked up, and the manufacturer's inventory was low.

ECOSEA prediction: The price of ‘TGIC curing agent’ is expected to be stable or increase slightly in the end of February and the beginning of March,2020.

-

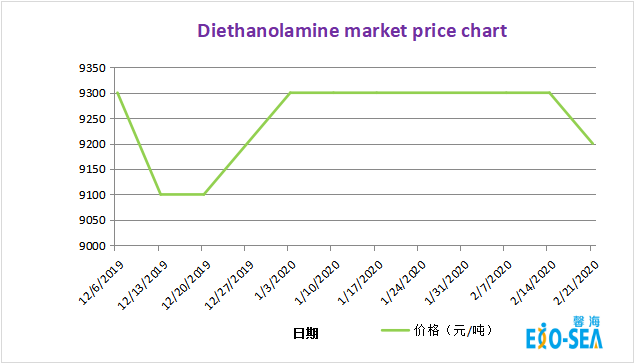

HAA curing agent

Raw material: This week, the DEA diethanolamine market is relatively flat. Some sources of goods attract buyers with a slight price drop, but the actual transaction orders are few, and most small orders follow up. Due to the impact of the outbreak after the Spring Festival, most of the factories are operating at low loads. Under the pressure of logistics, the factory ’s shipments are still seriously affected, and plus the influx of imported goods, the supply of goods in the entire market has gradually increased, and inventories have increased. But the downstream demand is flat and the inventory pressure of the factory is also more obvious. As there is no obvious sign of improvement in demand, they have recently been weak. In the short term, it is expected that diethanolamine will mainly stabilize or fall slightly. DMA dimethyl adipate's downstream market demand has been flat recently. Due to the impact of transportation and logistics, the transaction volume is relatively small, and the factory inventory is relatively sufficient.

Supply and demand: Affected by the pandemic , the company's resumption of work was delayed, logistics transportation was blocked, downstream customers' demand was flat, and overall market demand was weak.

ECOSEA prediction: The price of ‘HAA curing agent’ is expected to be stable in the end of February and the beginning of March,2020.